- PloutosX WealthTech Stories

- Posts

- 🗞️ Yieldstreet Losses Mount | Nevis Raises $40M | LIQID Adds ELTIF Access | Julius Baer Expands in Abu Dhabi | Bourbon Investing Gains Momentum

🗞️ Yieldstreet Losses Mount | Nevis Raises $40M | LIQID Adds ELTIF Access | Julius Baer Expands in Abu Dhabi | Bourbon Investing Gains Momentum

Hey WealthTech’ers 👋

📰 PloutosX WealthTech Stories – December 8th, 2025 is live. Your Monday reset to recap the key developments shaping WealthTech last week.

Private markets, digital wealth platforms, and AI-driven innovation continued to evolve, with new signals emerging around risk, advisory transformation, and global expansion. From major losses in retail alternatives to record early-stage funding for AI infrastructure, this week captures how rapidly the wealth ecosystem is shifting and how investors, institutions, and regulators are responding.

Last week: Yieldstreet’s investors absorbed losses exceeding $208 million as the firm rebranded to Willow Wealth, Nevis emerged from stealth with $40 million from leading global VCs to build AI for wealth management, LIQID partnered with Upvest to bring ELTIF access to digital investors, Julius Baer expanded its wealth management presence in Abu Dhabi, and CaskX spotlighted the growing demand for bourbon cask investing as a niche alternative asset.

Whether you are building, advising, allocating, or investing in this space, grab your coffee, scroll on, and start your week informed and ahead. ☕

Delving into the leading 5 wealthtech stories of the week:

🗞️ Story 1: “Yieldstreet investors face $208 million in losses as firm rebrands to Willow Wealth” ⚠️💼🗞️

Story 2: “Nevis emerges from stealth with $40M to build AI for wealth management” 🤖💰🗞️

Story 3: “LIQID partners with Upvest to bring ELTIFs to digital wealth clients” 📈🌍🗞️

Story 4: “Julius Baer expands its wealth management presence in Abu Dhabi” 🏦🇦🇪🗞️

Story 5: “CaskX taps into the rising bourbon investment market” 🥃📊

🗞 Story #1

$208 million wiped out: Yieldstreet investors rack up more losses as firm rebrands to Willow Wealth

Yieldstreet, once a high-profile platform offering retail investors access to alternative assets, has reported losses exceeding $208 million across a series of troubled investments. As the firm navigates the fallout, it has rebranded to Willow Wealth in an attempt to reset its strategy and regain credibility. The losses relate to multiple alternative investment products that underperformed or became impaired, highlighting challenges around due diligence, risk management, and investor communication. The rebrand signals a desire to reposition the company, but investors are still processing the impact of the reported losses.

💡 Why It Matters: This story underscores the vulnerability of retail-focused alternative investment platforms, particularly when underwriting standards, disclosures, or risk frameworks do not keep pace with product complexity. The $208 million loss figure highlights the scale of exposure investors can face when accessing private market products without institutional-grade oversight. Yieldstreet’s rebrand to Willow Wealth also raises questions about whether firms can rebuild trust after material losses. For regulators, advisors, and platforms, the situation is a reminder that demand for alternatives must be matched with robust governance, transparent risk modelling, and realistic performance expectations. This case may influence industry standards for retail access to private markets.

Image Credit: WillowWealth, Yieldstreet

🗞 Story #2

Nevis Announces $40M From Sequoia Capital, ICONIQ and Ribbit as It Emerges From Stealth to Build AI for Wealth Management

Nevis has exited stealth mode with a $40 million raise backed by Sequoia Capital, ICONIQ, and Ribbit Capital, signalling strong confidence from leading global investors. The firm aims to build AI systems that enhance portfolio construction, financial planning, and advisor productivity. Nevis positions itself as an infrastructure layer that supports both human advisors and digital platforms by automating insight generation, adapting recommendations to client profiles, and simplifying complex financial analysis. The funding round will accelerate product development and expand technical teams ahead of broader market rollout.

💡 Why It Matters: AI for wealth management is moving from experimentation into scaled deployment, and Nevis represents a new class of infrastructure-first players shaping this shift. Backing from major VC firms suggests expectations for rapid adoption across advisory firms, private banks, and digital platforms. As client expectations grow for personalised and always-on financial intelligence, AI systems like Nevis could redefine advisor workflows and compress time spent on research, suitability checks, and planning tasks. This also intensifies competition among incumbents who are upgrading their AI capabilities. The firm’s emergence may set new benchmarks for what AI-powered wealth management should deliver.

Image Credit: Nevis

🗞 Story #3

Germany’s Digital Wealth Manager LIQID Teams Up with Upvest for ELTIF Offering

LIQID, a leading German digital wealth manager, has partnered with Upvest to launch an ELTIF offering designed to make long-term private market investments more accessible. By using Upvest’s regulated investment infrastructure, LIQID can distribute ELTIFs through a streamlined digital experience that simplifies onboarding, subscriptions, and reporting. The initiative expands LIQID’s product shelf into private market exposure at a time when European regulations are promoting broader retail access. The collaboration combines LIQID’s client-facing platform with Upvest’s backend investment capabilities.

💡 Why It Matters: ELTIFs are becoming a central mechanism for democratising access to private markets in Europe. The LIQID–Upvest partnership shows how digital wealth platforms can integrate alternatives without building complex regulatory and operational systems in-house. This shift is significant because it marks the convergence of retail distribution, regulated investment wrappers, and digital-first user experiences. For wealth managers, it signals a move toward offering diversified, long-term products that were historically available only through private banks. As ELTIF adoption accelerates, platforms that execute well on product design, education, and liquidity expectations will have a strategic advantage.

Image Credit: LIQID, upvest

Story #4

Swiss Wealth Management Firm Julius Baer Announces Business Expansion in Abu Dhabi

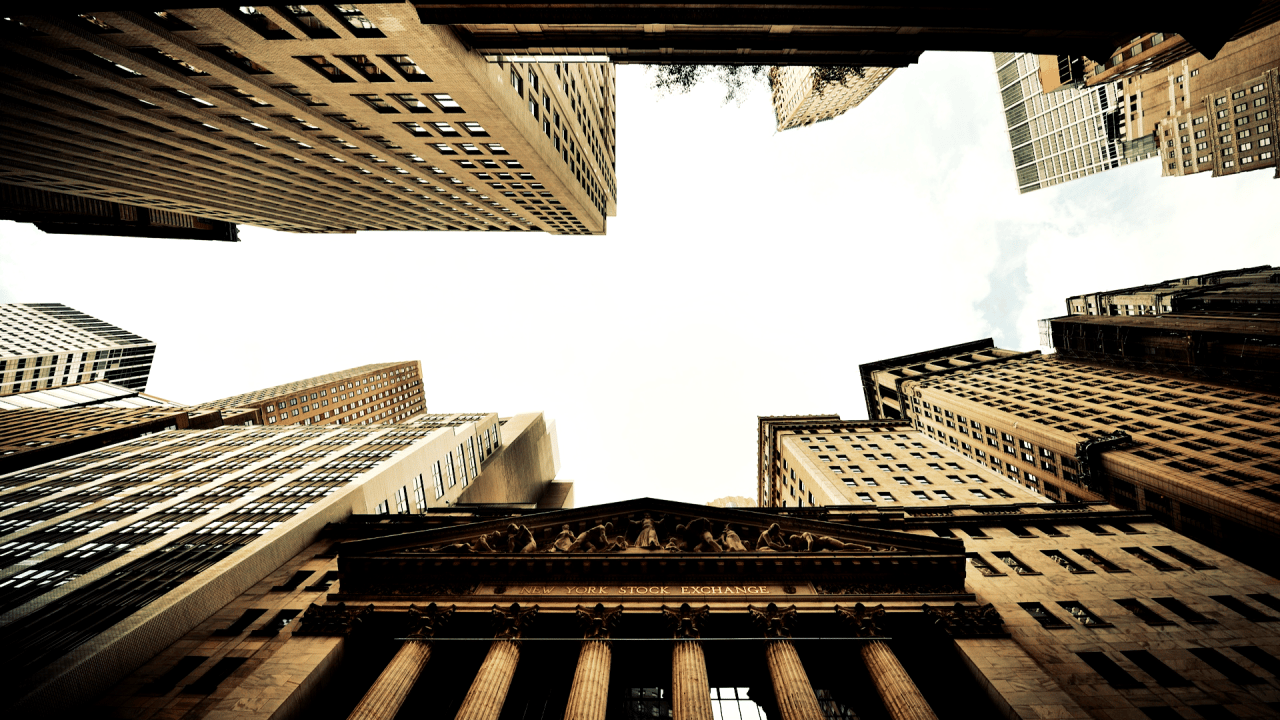

Swiss private bank Julius Baer has announced an expansion of its wealth management operations in Abu Dhabi, strengthening its presence in a region experiencing fast-growing demand for high-net-worth advisory services. The expansion supports the bank’s strategy of deepening its footprint across the Middle East, an area with rising wealth creation, cross-border investment flows, and a growing appetite for sophisticated planning and alternative solutions. The move aims to give clients better access to regional expertise and global investment capabilities.

💡 Why It Matters: Global wealth is shifting toward regions like the Gulf, where economic diversification and rising private wealth are transforming the advisory landscape. Julius Baer’s expansion reflects how international private banks are competing to serve UHNW and HNW clients with increasingly global portfolios. The move also signals Abu Dhabi’s growing status as a financial hub, supported by favourable regulation, investment inflows, and infrastructure designed for wealth platforms. For the industry, this highlights intensifying competition for talent, clients, and regional dominance in next-generation wealth centres.

Image Credit: nitpicker / shutterstock.com

🗞 Story #5

Beyond the Bottle: How CaskX is Tapping Into the Booming Bourbon Investment Market

CaskX is gaining attention as bourbon cask investing grows into a niche but expanding alternative asset class. The company offers investors exposure to aging bourbon barrels, positioning the category as a tangible asset benefiting from rising global demand for premium spirits. CaskX markets the strategy as a way to diversify into a physical commodity with potential appreciation tied to scarcity, aging dynamics, and brand value. Interest in collectible and consumable assets has increased as investors look beyond traditional markets and explore culturally driven alternative investments.

💡 Why It Matters: While niche, the bourbon cask market reflects a broader shift toward experiential, scarcity-based, and culturally anchored asset classes. These assets appeal to investors who seek diversification through items with both financial and lifestyle value. CaskX’s rise shows how alternative investment platforms are carving out verticals that extend far beyond private equity and credit. However, it also highlights the importance of understanding valuation drivers, storage risks, authenticity, and liquidity constraints. As more unconventional assets enter mainstream discussion, advisors must help clients navigate both the opportunities and the limitations of these emerging categories.

Image Credit: CaskX

And that's a wrap WealthTech’ers, till next week. 🎬👋

Thanks for tuning in to PloutosX WealthTech Stories, your weekly snapshot of the trends, people, and innovations shaping the future of wealth technology.

If you found these insights useful, please hit subscribe and share PloutosX WealthTech Stories with anyone who might enjoy staying ahead in the world of alternatives, AI, and wealthtech innovation.

Disclaimers:

(1) The opinions shared here are my own and do not represent the views of any organisation I am associated with.

(2) This newsletter is for educational purposes only and should not be interpreted as investment or financial advice.

Not a subscriber yet?

Get your WealthTech fix in just five quick minutes each week. 📰🚀🕒

By subscribing, you also become eligible (subject to approval) for the PloutosX Insider Circle, our invitation-only community offering private roundtables, leadership dialogues, and early access to our upcoming platform.

Reply